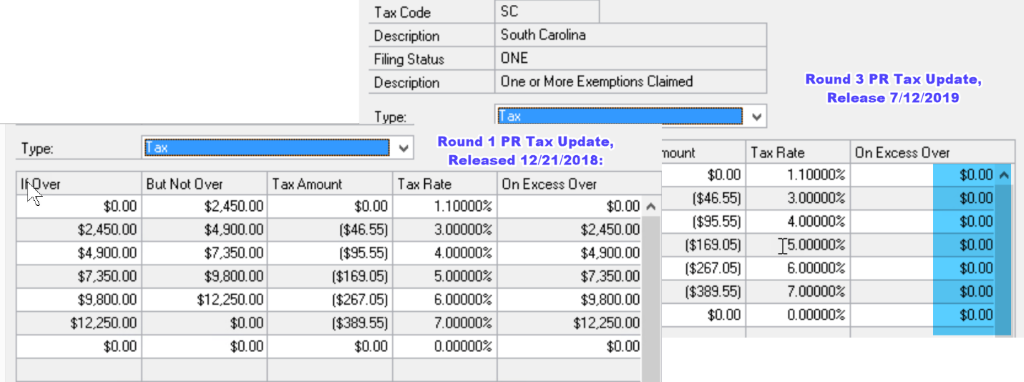

There was recently an unannounced correction to the Microsoft Dynamics GP 2019 South Carolina withholding tax. I am not sure if the error was discovered and corrected with the Round 2 or the Round 3 payroll tax update release; I can just tell you that I discovered it with the Round 3 tax update. A client contacted me asking why their South Carolina’s withholding tax jumped after installing the Round 3 update. This was a particular surprise because South Carolina was not one of the states listed on the update as having been included. The last announced update affecting South Carolina was the original 2019 Round 1 payroll tax update that all users install after the payroll year end closing.

Looking at the screen shot above, you can see that GP incorrectly included amounts in the “On Excess Over” column with the Round 1 release and corrected itself on a later release by removing these amounts. Had GP chosen to have positive Tax Amounts, then the excess amounts would have been correct. However, with their negative tax amounts combined with taxes calculated only on amounts over the excess restriction, South Carolina taxes were being under calculated. Therefore, with the correction, expect your South Carolina employee’s withholding to jump and continue to be higher than normal as GP works to bring their annual state withholding up to what it should be.

I’m not sure why the GP tax tables for South Carolina flipped the tax amount from the positive amount that you find on the rates released by the state to the negative amounts. However, I was able to prove that the calculations with the negative tax amounts are correct and match exactly the results from the state table if the “On Excess Over” column are zeros.

If you have any South Carolina employees and if you are still on Round 1 of the 2019 payroll tax rates, I highly recommend that you install the Round 3 payroll tax update as soon as possible. Otherwise, your SC employees will get an unhappy surprise when they file their state taxes for 2019. It will cause their withholding amounts to go up, but at least the correction is spread out over the remaining months in 2019 instead of getting a hard hit at tax time.

Learn more about our Dynamics GP cloud offering at PowerGP Online.