Welcome to 2020 year-end and all the fun changes for 1099’s! This year, the IRS has released a new 1099NEC form that is required for 2020 tax reporting for Non-Employee Compensation (NEC). NEC information was previously reported in Box 7 on the 1099-MISC form, so a whole new form is required this year.

To accommodate this, Microsoft has made the following changes:

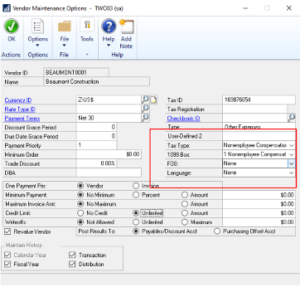

- The Tax Type of Non-employee Compensation has been added to the Vendor Maintenance\Options window.

- You can view NEC 1099 details from the 1099 Details Inquiry window.

- Non-employee Compensation is a selection option when printing 1099s.

The easiest way to update vendors for this new tax type is to use the Update 1099 option under Purchasing\Utilities. This will let you mass change tax type and update transactions as well. Please keep in mind that Box 7 on the 1099-MISC is now used for something else so make sure any vendors that are still setup as 1099-MISC vendors may need to be reviewed.

In order to get this functionality, Dynamics GP users will have to upgrade to the latest Dynamics GP release – version 18.3 or 2016 year-end update. This functionality will NOT be available for those on GP2015 or older.

Alernative Options

That said, there are alternatives available if you’re on a version of GP that won’t get a year-end update, if you won’t have time to do an upgrade or if any of your ISV (add-on) products won’t be compatible in time.

Here are some of the other ways you can handle your 1099NEC filing.

Options we are familiar with and/or have used before:

- In addition to the integration with GP, Greenshades offers a template that will allow you to upload your data where they can parse it and send out your 1099s. Please note, you must already own or purchase the Greenshades 1099 filing option.

- W2-Mate With W2-Mate you run your 1099 edit list to file and then import it into W2-Mate for IRS upload file creation. Note on this one, make sure you tell them what state you are filing for when you order. Some states (like Oklahoma) have slightly different instructions.

- Aatrix charges based on the number of 1099s you are going to process so this could be a great option for those with only a handful of 1099s.

- Ebizfile allows you to manually enter your data or upload an Excel file and then they will file electronically and or print/mail forms.

Additional options that we are aware of but do not have first-hand experience with:

- Yearli – formerly Winfiler by Greatland Business Forms. https://yearli.com

- Zemworks 1099Tax Forms. tax1099.com

- 1099 Pro Software. http://1099professional.com

- Integrated Data Management Account Ability https://idmsinc.com

- Checkmark 1099-software https://www.checkmark.com